Mr. Speaker,

It is my privilege to rise in this Honourable House to provide my contribution to this 2017/2018 Budget Debate as the representative for the great people of the Constituency of St. Anne’s.

MINISTRY OF FINANCIAL SERVICES, TRADE & INDUSTRY, HEAD 49

In the Ministry of Financial Services, I am charged with the following responsibilities: the promotion of Financial Services Sector, International Trade, the Industries Encouragement Act, and the establishment of an International Commercial Arbitration Centre in The Bahamas.

The Ministry received an allocation of $2,858,750 during the 2017/2018 fiscal year, in order to achieve this mandate.

FINANCIAL SERVICES

Mr. Speaker,

Financial Services, the second pillar of our economy, second only to tourism accounts for more than 17% of the GDP of The Bahamas and more than 4,000 jobs directly and some 16,000 indirectly, representing more than 13% of total employment. Financial services also generate substantial government revenues of approximately $200 million accounting for up to 19% of the tax base.

Mr. Speaker,

With over 250 licensed banks and trust companies originating from some 210 countries with over $300 billion in balance sheet assets, job opportunities in the financial services sector continue to support the middle-class in The Bahamas and are among the most highly paid and rewarded jobs in the country. It is the middle class of course, that provides the pulse for the creation of new businesses and opportunities to the rest of the Bahamian society. Further, it is these same financial institutions that invest in the professional training of their employees to improve and grow their intellectual capital resources, resulting in an increase of human resource capital in The Bahamas, thus providing an invaluable contribution to continued professional development in financial services.

Mr. Speaker,

As one of the world’s most important financial centres, The Bahamas has a responsibility to uphold investor confidence by maintaining a stable business environment where conducting business is friendly and efficient, and where the rule of law is clear coupled with a sound regulatory framework.

The Bahamas must send the message to the world, that we are a reputable offshore international financial centre. We must focus on ensuring that the integrity of the country’s second economic pillar remains intact. And we must continue to ensure that we meet our international regulatory commitments as we work to place ourselves ahead of other offshore international financial centres, by taking the lead and setting the standard which others must follow.

We must take bold, decisive and innovative steps to manage our way through the ever-changing global regulatory landscape, technological advances in the way business is conducted and the increase in competition among our regional counterparts to meet the needs of investors. It must be our priority, in all of our actions, to protect jobs, to create policies that facilitate the ease of doing business for investments and the provision of financial services, and to return our Bahamian economy to the path of sustainable growth. We will seek to do this in a manner that is fair and equitable, and that protects the most vulnerable, for the greater good of our Bahamian society.

RESTORATION OF THE BAHAMAS VALUE PROPOSITON

Mr. Speaker,

As we seek to renew and restore The Bahamas’ brand as the “Clear Choice” for international financial services offshore, we must capitalize on our known advantages, namely; location, innovation, regulation and expertise. These attractive advantages along with political stability, an attractive tax regime and cost structure, our common law traditions, skilled and educated workforce, modern infrastructure and a warm and welcoming climate for investor friendly business, has continually upheld The Bahamas as one of the leading international financial centres.

My Ministry will be analyzing the international competitive landscape to identify and develop initiatives to strengthen the local financial services community and to assist our efforts in maintaining and improving The Bahamas’ brand as a full international financial services centre.

Mr. Speaker,

This year we continue our partnership with the Society of Trust and Estate Practitioners, otherwise known as STEP, to participate in and sponsor some of their conferences to facilitate a more global outreach of what The Bahamas has to offer, particularly STEP Caribbean which was held in May of this year in the Cayman Islands. The Bahamas had a strong presence with over 20 delegates attending this event. There are also plans to attend STEP LatAm (Cartegena, Colombia), STEP Australia (Brisbane, Australia) and STEP Asia (Singapore) later in the year. We will also participate in the Private Wealth Management conference for Latin America and the Caribbean in Miami as well as some new conferences to bring more focus to our insurance products and that lend a more strategic focus to attracting business to The Bahamas.

In researching what has worked in the past, we are planning more targeted summits conducted by the Bahamas Financial Services Board like the one held in Montreal and Toronto, Canada at the end of May 2017. This event attracted more than 200 professionals, investors and financial services intermediaries and was broadcast via Guardian Radio with host Zhivargo Laing adding an even more valuable contribution to what has been touted as a resounding success. It is our intention to duplicate these efforts in New York, Switzerland and London before the end of this year. Through BFSB, we have been engaging more private sector partners as we continue to collaborate efforts for the sustainability and success of the financial services industry in The Bahamas.

Mr. Speaker,

Not only does attendance at these conferences and summits display the government’s commitment to the financial services industry which aids to facilitate confidence in doing business with The Bahamas, it also provides tremendous opportunities to network with a large number of industry participants, helps to expose my Ministry to a better understanding of how best to work with the industry to structure policies and tailor new products that make our jurisdiction more attractive, while allowing us the opportunity to take the message to the world, that The Bahamas has the capability and resources to help make their business and investments successful. We are able to explain face to face, what we consider to be “The Bahamas Advantage” and why The Bahamas should be their clear choice. These are key components in our strategy to preserve and grow our financial services sector.

Innovation

Mr. Speaker,

As the Minister of Financial Services, I am aware of how much depends on the success of the sector in a volatile industry. To be attractive and relevant to the needs of potential investors and other financial services intermediaries, The Bahamas must be innovative in the development of new products and diverse in the provision of services that adapt to the ever-changing needs of users of financial products and services.

Our most recent product innovations in financial services over the last five years were the Investment Condominium (ICON) and the SMART Fund Models. It is critical that we continue to collaborate efforts between the government, regulators and the private sector to continue to be innovative as we look for new ways to mitigate against any future loss of business and to grow the financial services sector. Innovation is strategically important in all respects for The Bahamas to support the financial services sector and to allow commerce to advance to improve the country’s economy; these include service delivery, communication, infrastructure, transportation, and immigration. Together, these create a platform for the ease of doing business in The Bahamas.

Ease of Doing Business

Mr. Speaker,

The Bahamas is not one of the easiest places to do business. The Bahamas was ranked 121st by The World Bank Group Doing Business 2017 Report with a score of 59.0 which is considered far below the regional average for the Ease of Doing Business. The Bahamas dropped from 120th to 121st out of 190 nations according to the World Bank Table with New Zealand ranking at number 1 and Singapore ranked at number 2. The Doing Business data showed continued successes in the ease of doing business worldwide, where starting a new business now takes an average of 21 days worldwide, compared with 46 days 10 years ago. The Bahamas is ranked 118th in this area – it takes 8.0 procedures, takes 21.5 days, and costs 13.8% of income per capita. It is worth noting that Jamaica is ranked 67th overall.

The Bahamas maintained its ranking in the areas of enforcing contracts at 75th; registering property increased in rank from 184th to 166th largely due to the cost of transferring property in The Bahamas being reduced and received the highest drop in ranking in the category of ease of paying taxes, from 22nd to 95th in the world. The tax policy in The Bahamas must be pro-enterprise to foster sustainable economic growth. However, in the area of the ability to obtain credit, The Bahamas is dropped in rank from 134th to 139th. This is very significant, because the ability to get credit and to borrow is an important component in creating new business opportunities, growing existing business and improving the quality of life for many people. This is one of the reasons why we have a stagnant economy. Small and medium sized enterprises and businesses as well as entrepreneurs are the true engines of any economy. In order to grow and strengthen their business and bring their ideas to reality, they must have the ability to borrow. We must create new avenues to do this by revamping our exchange control policies, giving citizens of The Bahamas the ability to trade easily in foreign currencies, borrow against Bahamas based assets internationally and make investments to grow their capital. This includes the ability of insurance companies and pension funds to make investments. All of this aids in the growth of our economy. An economy that only reinvests in itself cannot expand. We must review our credit system to support healthy businesses and sustainable jobs.

Mr. Speaker,

These rankings are unacceptable. We have a lot to improve upon and the time to act is now. All Bahamians must take ownership in this process as we work toward service excellence. The government can set policies, and through private and public-sector partnerships can provide infrastructure and technology to set the parameters as to how business can be conducted, but it will take all of us, as a people to ensure the experience is second to none.

The Bahamas must make doing business easier through reforms in the cost of doing business, the amount of time it takes to establish a business, inclusive of the process of obtaining licenses, paying taxes, and the delivery of friendly and efficient service while maintaining its trust and integrity as a reputable jurisdiction.

Immigration

In order to improve the ease of doing business and foster growth in the financial services sector, as Minister of Immigration, pursuant to Section 29(e) of the Immigration Act, I will consider making an Order to create an exemption to the work permit requirement for Short Term Work Permits for persons entering The Bahamas for the purpose of a business visit, inclusive of a business meeting, client meeting, conference, training meeting, board meeting, intra-company business meetings for periods of 7 or less calendar days that total no more than 30 days per calendar year. This is done in practice generally for the most part, but possibly it should now be made official.

We are also looking at the establishment of an online application system to expedite the application process to make this process more efficient.

Mr. Speaker,

My Ministry will review the current threshold for permanent residency without the right to work program which allows property owners of residences valued at a minimum of five hundred thousand Bahamian dollars (B$500,000.00) to qualify for permanent residence and consider whether or not to increase the threshold from $500,000 to $750,000.

Further, there have been numerous requests from the international community for a tax residency certificate programme. This involves a tax residence certificate being issued to those persons who have stayed a minimum of ninety (90) to one hundred and twenty (120) days in The Bahamas. Persons who already hold permanent residency would also be eligible to apply for a tax residence certificate. The introduction of a tax residency certificate would increase revenues and allow for the possibility of The Bahamas to consider entering into double taxation treaties.

These proposed changes in immigration policy are inline with the global changes to allow for more business efficiency and provides greater incentive for potential investors to do business in The Bahamas.

Human Resource Capital

Mr. Speaker,

The Bahamas boasts a highly skilled and educated workforce through which we have been able to provide adequate resources to support the financial services sector. However, in order to grow, new skills will be required as we see a shift in the way business is being conducted, the need for specialty skills, and to meet the needs of technological advances that have changed how businesses interface. This requires forward thinking to be able to prepare to meet those needs by investing not only in those currently in the workforce, but students who have not yet joined the workforce.

Through my Ministry, a grant from The European Union (EU) facilitated by The Caribbean Development Bank (CDB) is making it possible for us to demonstrate to the world, our commitment to educating and equipping our financial services workforce to meet and maintain quality standards. We will be establishing here in The Bahamas, a “Centre for Excellence” to facilitate professional skills development in financial services for the entire region.

A consultancy firm has just completed their report on how best The Bahamas can establish The Centre for Excellence which we are confident will further solidify The Bahamas’ position as a premier financial services jurisdiction and display government’s commitment to investing in human capital resources through education to ensure the cultivation of knowledge.

Mr. Speaker,

The Centre for Excellence will be an expanded, and diversified, regional-level training and research organization, and discussion forum for the financial services sector bringing together students, professionals, businesses, technology and entrepreneurship together in one village to become a recognized, leading provider of professional services for financial sector development in the Caribbean, addressing gaps in competencies arising from the changing market and regulatory environment. It will undertake training and research and will be an authoritative information source on Caribbean and global financial services issues. It will provide a forum for cooperation and knowledge sharing between industry, regulators and Governments, and will develop a capacity for standards setting within the financial sector.

Further, it is my vision that as we develop this highly innovative village it will envelop financial technology (Fintech) and provide for private sector partners to help bring this to reality, whether it be in the form of boutique hotels, office structures, architecture, communications infrastructure, branding, library resources, internship programs, research fellows, and new business in a tax neutral environment. This centre will continually train our professional human resources, provide much needed research for the region on financial services and how we are to plan for the future, give incentive for new business opportunities, provided jobs, spark innovation and creativity, attract bright minds and self-starters to be more entrepreneurial and bring more visitors to our shores. This is how we change the way we do business, this is how we lead, this is what the new Bahamas looks like.

GLOBAL CHALLENGES AND OTHER INTERNATIONAL INITIATIVES

Mr. Speaker,

The financial services industry has experienced rapid changes in regulatory and tax initiatives in the last decade, mainly due to the global economic recession and increased competition.

In order to continue to be respected in the global community, The Bahamas must continue to adapt to changing external international regulatory requirements. The Bahamas government is committed to complying with global standards in a manner that upholds an appropriate and acceptable balance of client confidentiality as international standards on information exchange and cooperation continue to develop and expand. It is worth noting that the Organization for Economic Cooperation and Development (OECD) rated The Bahamas as largely compliant with its standards during its peer reviews.

There are many challenges as banks and other financial institutions are faced with increased global regulatory demands, structural changes, and costs to do business in certain jurisdictions. These challenges are not confined to any particular category, and in the last few years, we have seen both local and offshore banking affected here in the Bahamas. There have been job losses with the latest statistics in the November 2016 report showing unemployment in The Bahamas at 12.5% to 14.8%. Of this percentage, business and financial services (directly and indirectly) accounts for roughly 35%. It is clear, we must make changes to make The Bahamas more attractive and to make doing business in The Bahamas more viable.

Financial Action Task Force (FATF)

Mr. Speaker,

The international standard setting body for anti-money laundering and counter-terrorist financing has several regional arms such as the Caribbean Action Task Force (CFATF). This body conducts regular reviews on the extent and effectiveness of a country’s anti-money laundering regime.

Of particular note is that due to the FATFs revised recommendations on de-risking, banks in The Bahamas have adopted a risk-based approach to ensure that their anti-money laundering and counter terrorist financing (AML/CFT) standards are in line with that of the FATF guidelines to mitigate against any possible risks. Many banks identified as having deficiencies by the FATF or high risk for AML/CFT experienced a decline in their correspondent banking relationships. Correspondent banking relationships exist between banks providing financial services (correspondent banks) and those receiving those services (respondent banks). This has not greatly impacted The Bahamas, but we continue to monitor this process and engage in the dialogue to prevent any further effect in the region.

Foreign Account Tax Compliance Act (FATCA)

Mr. Speaker,

Other initiatives include the Foreign Account Tax Compliance Act (FATCA), a tax information exchange initiative formulated by the US as a part of their efforts to improve tax compliance involving foreign financial assets and offshore accounts. Our commitment to aspire to being fully committed and leading the way as a clean jurisdiction was evidenced by our successful implementation of FATCA.

OECD Common Reporting Standard

Mr. Speaker,

The most recent international tax initiative affecting The Bahamas is the Organization of Economic Cooperation and Development’s Reporting Standard (the Standard) which was developed in response to the G20’s request and approved by the OECD Council on 15th July, 2014. It calls on jurisdictions to obtain information from their financial institutions and automatically exchange that information with other jurisdictions (interested parties) on an annual basis. The Bahamas committed to adopt the Standard by means of bilateral treaties with interested and appropriate partner countries with the first exchange of financial account information to take place in September 2018. Last month, The Bahamas government has agreed to sign the Multilateral Convention on Mutual Administrative Assistance in Tax Matters (MAC) in order to meet this deadline and in the best interest of The Bahamas. Mr. Pascal St. Amans of the OECD stated in a recent press release that this is a very significant step forward in implementing The Bahamas’ commitment to tax transparency and effective exchange of information. This was the most sensible thing to do at this time in order to preserve the good reputation of The Bahamas’ financial services industry, to avoid blacklisting and mitigate against large potential fallout. Given all the facts, it was the right decision to make, we must now move to successfully implement the Common Reporting Standard so that we can move on to concentrate our efforts on creating new opportunities to grow the sector.

To legally effect compliance with the Standard, The Automatic Exchange of Financial Account Information Bill was enacted in December 2016 and came into force on January 1st, 2017. The Automatic Exchange of Financial Account Information Regulations 2017 was finalized in February 2017 and the Draft Guidance Notes to the Regulations were disseminated to the financial services industry in March 2017. In preparation for The Bahamas’ 2018 implementation, the CRS Task Force comprising of all major stakeholders including the Ministry of Finance as the portfolio Ministry, the MOFS, OAG, BFSB and Private Sector representatives has been working diligently to ensure compliance with the OECD’s preparations, drafting and amending legislation, attending meetings, conducting industry briefings and press releases and coordinating the entire effort through the Ministry of Financial Services. Our work on this initiative is key to the survivability of the sector and my Ministry is committed to ensuring its success.

The process to becoming a party to the Multilateral Convention could take us to the end of 2017. In the meantime, we must continue our efforts to engage interested parties, legislation will have to be drafted once we are accepted as a signing partner to the Multilateral Convention and there will be more industry briefings to inform the financial services industry of our progress to ready ourselves for the 2018 implementation.

TRADE & INDUSTRY

Mr. Speaker,

In the speech from the Throne, the Governor General noted the Government’s commitment to harnessing the energy of the Bahamian people and the Ministry of Financial Services will do its part in those areas for which I have ministerial responsibility.

Mr. Speaker,

Given the country’s continued reliance on tourism, financial services and foreign direct investment as drivers of the economy, we must create jobs to reduce unemployment particularly among our youth, improve the standard of living of the Bahamian people in New Providence and the Family Islands and we must find ways to diversify the economy.

Trade provides a vehicle that we can use for economic diversification, job creation, growth, and sustainable development. The Ministry of Financial Services which has responsibility for trade will continue and complete a number of initiatives presently underway which impact the Government’s Trade agenda.

In that regard Mr. Speaker, the Government is mindful of both the benefits that can accrue from trade but also the vulnerabilities of the Bahamian economy. As a small archipelagic nation, remaining outside trading arrangements is no longer a viable option for The Bahamas when decisions which can impact our country’s future development are being made.

IDB Loan

In that regard my Ministry has oversight of Component III of the Government’s $16.5 million loan Agreement with the Inter-American Development Bank titled: Trade Sector Support Programme, BH-L1016 which was obtained in August 2012. Component III is aimed at strengthening trade-related institutions and ensuring that The Bahamas has in place relevant laws and institutions in keeping with the country’s international trade obligations and international best practices, while also supporting the Government’s efforts to use trade as a vehicle to support economic development and economic diversification.

There is recognition that we lack capacity in some areas and new institutions must be created or existing ones strengthened to enable us to participate effectively in the global trading arena. Consultancies undertaken with funding used under Component III of the IDB loan will assist the country in addressing the capacity constraints of trade related institutions in The Bahamas, which is crucial for the participation of The Bahamas in international trade negotiations, and the implementation of obligations under present and future trade agreements.

The institutional and structural reforms that will be undertaken to advance a trade agenda are necessary to boost productivity and enhance the competitiveness of the Bahamian economy, while creating an environment conducive to attracting foreign direct investment.

However, if we are to empower Bahamian professionals, there is also an urgent need for them to partner with international consultants engaged under contracts with the Government to ensure knowledge transfer. The need for training on proposal writing is important if Bahamian professionals are able to successfully compete for these contracts.

One such consultancy of particular note is a Vulnerability Study to advise the Government on various policy options that the Government should deploy to deal with those sectors of the economy identified as most vulnerable to increased foreign competition arising from trade liberalization. As part of the terms of reference of that consultancy, the consultants were to collaborate with the University of The Bahamas. The Consultants have concluded their research and consultations and will be reporting to Government on their findings shortly.

The Economic Partnership Agreement

Mr. Speaker,

The genesis of the Economic Partnership Agreement, the only trade Agreement signed by The Bahamas in 2008 stems from the 2000 Cotonou Agreement, a treaty between the European Union (EU) and the African, Caribbean and Pacific Group of countries (ACP). The Cotonou Agreement, which replaced the Lomé Convention, was designed to establish a comprehensive partnership Agreement between the European Union (EU) and ACP Countries building on the three (3) pillars of Development cooperation, Political cooperation and Economic and trade cooperation. In addition, the Agreement provided for the negotiation of new trading arrangements between the EU and ACP with a view to liberalising trade between the Parties, putting an end to the system of non-reciprocal trade preferences from which ACP States benefited and which did not comply with the rules of the World Trade Organization.

In that regard in 2008 The Bahamas, other CARICOM Member States and the Dominican Republic (CARIFORUM) negotiated and signed the reciprocal albeit asymmetrical Caribbean Forum (CARIFORUM) Economic Partnership Agreement (EPA) with the EU. In October 2012 The Bahamas finalized its commitments under the EPA by incorporating its trade in services and trade in investments commitments into the Agreement.

Mr. Speaker,

The Agreement required more from the EU and made much lighter demands on Caribbean states like The Bahamas. The CARIFORUM EPA opens up and enhances trade between Europe and CARIFORUM by providing market access to a wide range of products and services. It ensures duty-free-quota-free market access of products from CARIFORUM member states like The Bahamas into the EU. The Agreement makes it possible for CARIFORUM companies to set up a commercial presence in the EU.

Mr. Speaker,

As a member of CARIFORUM the Agreement has the potential to improve the way products and services are imported and exported to and from The Bahamas into the EU and other CARIFORUM Member States. It is another step which facilitates the ease of doing business.

Mr. Speaker,

Trade Agreements that developing countries like The Bahamas negotiate, often include important technical capacity opportunities. The EPA is no different. The EPA provides an important tool which can be used by Bahamian businesses to increase trade opportunities and to diversify our economy.

The Economic Development Fund of the EPA helps CARIFORUM countries like The Bahamas implement the agreement. The agreement provides an opportunity to catch up, and to build capacity. It provides opportunities for The Bahamas to access invaluable technical assistance and funding available under the Agreement. Even though The Bahamas is ineligible for EU aid because of the principle of graduation caused by our perceived high per capita income, the country is eligible to take part in regional programmes and to benefit from those programmes.

Mr. Speaker,

In that regard, The Bahamas was able to obtain three Grants under the 10th Economic Development Fund (EDF) component of the Agreement.

1. With grant funding for a Technical Study: Establishment of a Caribbean Centre of Excellence for Financial Services in The Bahamas, the international consulting firm GBRW was retained. They have completed their work and recommendations on the establishment of a Caribbean Centre of Excellence for Financial Services (CCEFS) which will be provided to the 41 Government shortly. The establishment of a CCEFS is part of a long-term effort to improve the Region’s economic prospects and long-term development outlook through the establishment of training and research institutions for the region’s financial services industry. The training mandate of a CCEFS will help to develop a well-trained and skilled cadre of financial professionals.

Mr. Speaker,

2. Trade Information Service for The Bahamas

In that regard, with resources under the 10th EDF of the EPA, The Bahamas was able to establish a Trade Information Portal. The ongoing work associated with the Portal, a collaborative public private initiative between the Ministry of Financial Services and The Bahamas Chamber of Commerce and Employers’ Confederation will continue. The Trade Portal’s establishment is an important business facilitation measure which will reduce the cost and time required to access trade information on The Bahamas, effectively improving the ease of doing business in The Bahamas.

The Government’s support for the engagement of a Trade Information Specialist to administer the Trade Portal in collaboration with the Chamber of Commerce and Employers’ Confederation will ensure that information on the Portal is both relevant and current. The Government will continue to provide resources to fund the salary of the Portal Manager. The Government has also identified resources for the further enrichment of the Portal and additional training for the Portal Manager and Statisticians at the Department of Statistics to ensure that statistical reports on the Portal are current and user friendly. Registration on the Portal is free. I would like to encourage Bahamian business who wish to export or bring visibility to the goods or services they can provide to register on the Portal.

Mr. Speaker,

3. Institutional Strengthening for EPA Implementation in the Commonwealth of The Bahamas

With Grant funding under the 10th EDF, The Bahamas was able to obtain funding for three small but important projects which will benefit the country’s trading regime:

- A project to provide support to The Bahamas Bureau of Standards and Quality (BBSQ) in building a National Quality Infrastructure (NQI). This project aims to facilitate EPA implementation by supporting the competitiveness of Bahamian products on international markets and enhancing consumer protection.

- A project to strengthen the EPA Implementation Unit within the Ministry of Financial Services and assist the Unit in developing an Implementation Strategy to implement the provisions of the Agreement with public and private stakeholders; and

- A project to assist the Ministry of Financial Services in developing a communication strategy to bring more visibility about the agreement and increase the understanding of stakeholders on how to take advantage of the opportunities presented by the EPA.

These Projects have now been completed and their results and recommendations are being provided to the Government.

Industries Encouragement Act (IEA)

Mr. Speaker,

In the speech from the Throne, the Governor General noted the Government’s commitment to ensure the purchase of locally manufactured goods and services and other supplies. The Governor General also noted the Government’s commitment to enact legislation which allows duty free concessions on all construction materials and building supplies used in the construction of business premises. In that regard, my Ministry will continue to provide support to local manufacturers and potential manufacturers who apply for duty free concessions under the Industries Encouragement Act (IEA). Applicants who qualify under the provisions of the Act will be able to obtain customs duties exemptions on items such as machinery, equipment, tools and raw materials, used in the manufacturing of an approved product under the Act.

Additionally, customs duty exemptions can be provided to an Approved Manufacturer under the Act for materials or appliances necessary for and used in the construction and alteration of the factory premises or articles imported for the purpose of constructing, altering, reconstructing or extending the applicant’s factory premises.

During the upcoming budget cycle, the Ministry will undertake a sensitization initiative to sensitize Bahamians about the application process under the Act. We intend to make this process more transparent to the public. Such a workshop I believe is important to increase awareness of the benefits available to Bahamian entrepreneurs under the Act and in so doing encourage the development of small and medium sized enterprises.

World Trade Organization

Mr. Speaker,

I would like to take this opportunity to update Bahamians on The Bahamas’ application to become a member of the World Trade Organization, the organization made up of member states that make the rules to govern international trade. The WTO is fast becoming an organization of universal membership. Although The Bahamas has observer status, it is only members of the organization who truly have a say on the rules governing global trade.

Remaining on the fringes of the WTO, the body which sets the global rules for trade is no longer a viable option for The Bahamas.

Mr. Speaker,

The accession process is essentially a three stage process towards membership: (1) establish a Working Party; (2) engage in negotiations and (3) complete the procedural formalities of the accession process.

The role of the Working Party is to examine the application of the government to accede to the WTO and to submit any recommendations it may have to the General Council/Ministerial Conference on the terms of accession. Membership in the Working Party is open to all WTO members, and generally consists of Members that have a specific interest in trade with the acceding country. In accession Working Parties, WTO members and the acceding government negotiate the terms of accession.

In terms of the actual formalities associated with The Bahamas’ application, in 2001 The Bahamas formally submitted its application to become a member of the WTO and began the process to become a member of the organization. Admittedly, the application process has been sporadic over the past 16 years. In July, 2015 we submitted the Factual Summary of Points Raised document (Factual Summary) to the WTO Secretariat which summarizes the discussions in the Working Party. The WTO Secretariat has given its initial assessment of the document and provided invaluable feedback.

As membership in the WTO is through negotiation, The Factual Summary gradually develops into the Draft Working Party Report (DWPR), which contains the terms on which a country like The Bahamas that is applying to become a member of the WTO would become a member of the organization.

To date, The Bahamas has participated in two Working Party Meetings with other WTO Member States on the application of The Bahamas to become a member of the WTO. The two Working Party Meetings were held on 14th September, 2010 and again on 21st June, 2012. During the 16 years since The Bahamas submitted its application for membership, the WTO has offered technical assistance to build capacity among technical staff to assist The Bahamas advance its application.

Mr. Speaker,

To date The Bahamas has submitted an Initial Goods Offer to the WTO in March, 2012. Negotiations on tariffs concessions which are the essence of a Goods Offers are conducted on the basis of offers and requests. Typically, an acceding country like The Bahamas provides initial tariff offers after the first meeting of the Working Party. WTO Members submit their requests to the Government. As the negotiations advance, the Government might be invited to revise its offer. The number of rounds of negotiations depends on the quality of the offers and the complexity of the issues involved. The consolidated, verified Goods Schedule of the acceding government becomes its ‘final offer’ to the WTO.

An initial Services Offer was also submitted to the WTO in March 2012 and a revised Services Offer was submitted in August 2013. Negotiations on services are also conducted on the basis of offers and requests between the acceding government and interested WTO Members. As the negotiations advance, acceding governments may be invited to revise its market access offers. The number of rounds of negotiations depends on the quality of the offers and the complexity of the issues involved.

In that regard, further revisions were made to both Offers to take into consideration requests that were made as a result of bilateral negotiations and further stakeholder consultations. To date The Bahamas has held bilateral negotiations with the United States (in June 2012 and March 2013), the European Union (June 2012), Canada (June 2012), Costa Rica (June 2012), and Brazil (September 2012) and Chile (January 2013) as it relates to the Goods and Services Offers made by The Bahamas.

As negotiations continue and The Bahamas receives further requests on its Goods and Services Offers from interested WTO Members, further consultations will need to be held with domestic stakeholders.

Mr. Speaker,

In terms of the legislative reforms necessary for WTO accession, the Government believes that the steps are less burdensome for The Bahamas. This is because once The Bahamas signed the CARIFORUM EPA and committed to the obligations under the agreement, many of the legislative changes necessary for WTO accession are in line with changes required to implement the CARIFORUM EPA.

In that regard, in 2015 a compendium of Intellectual Property Rights legislation was enacted by Parliament. My Ministry will be cooperating with the office of the Attorney General and the Registrar General to see that the accompanying Regulations to bring the new legislation into effect are drafted. The new Customs Management Act, 2013 creates a regime for the imposition of countervailing duties in the case of subsidized imports that have the ability to injure domestic producers. Anti-dumping legislation has also been drafted and is currently being finalized for consultation. Metrology and Standards Bills which are important to the work undertaken by The Bahamas Bureau of Standards and Quality are also being finalized for consultations.

Presently my Ministry is advancing a consultancy to prepare Draft Competition (Antitrust Legislation) building on an existing Draft Competition Bill, developing scenarios for institutional design of a competition agency taking into account the powers and functions of URCA under the Communications Act and models existing in other CARICOM jurisdictions.

Mr. Speaker,

As we continue to advance the Government’s legislative agenda and finalize those issues that impact the trade agenda and the WTO accession process of which I spoke, my Ministry will seek to have a Third Working Party meeting to advance the WTO accession process.

Trade Commission

Mr. Speaker,

Given the foregoing, the work of The Bahamas Trade Commission becomes of extreme importance. The Commission is made up of representatives from both the Public and Private sectors. The work of the Commission includes public awareness and sensitizing the Bahamian public and the business community about the effects of trade liberalization on the Bahamian economy, the full implications of trade agreements, and making recommendations to the Government and/or creating a plan to integrate trade agreements into everyday business activity in The Bahamas.

My Ministry which serves as the Secretariat for the Commission will continue to lend support to the work of the Commission. In that regard an important initiative of the Commission started in 2016, to undertake a Survey on trade awareness among Bahamians and to sensitize Bahamians as to how trade agreements can impact them, will be completed during the upcoming budget cycle.

Arbitration

Mr. Speaker,

The Government will continue efforts to advance The Bahamas as an International Arbitration Centre. The Ministry of Financial Services which has responsibility for international arbitration, will survey relevant stakeholders to enable the Government to better assess how firms and commercial entities choose an arbitration venue. Once the information is collected, this would enable the Government to have a good perspective on firms and commercial entities wanting to do business in The Bahamas and should enable the Government to understand what is needed to position The Bahamas as a leading arbitration centre. After such consultation a new draft International Arbitration Bill which is important to support this initiative, will be circulated to stakeholders for input.

DEPARTMENT OF IMMIGRATION

Mr. Speaker,

The role of the Department of Immigration, of course, is to regulate the movement of people into and out of the country, and to process applications for work, home owners’ residency and spousal permits and citizenship.

The Department of Immigration, Head 30 received an allocation of $21,764,798.00 to carry out its mandate during the 2017/2018 fiscal year.

Mr. Speaker,

Revenue Accrued

As you are aware, the Department of Immigration is a revenue producing agency. The revenue figures for the fiscal periods 2012-2017 is $232,154,514.00.

The average revenue per fiscal year, was approximately $50 million was and revenue for the July 2016 to March 2017 fiscal period, 9 1⁄2 months is approximately $36 million.

Activities During The Past Fiscal Year

Mr. Speaker,

A significant amount of funds were spent on repatriation exercises over the last fiscal year. An initial $800,000 was allocated to the Department’s budget. However, due to increase in Cuban and Haitian migrants apprehended within the country’s borders an additional $600,000 was requested from the Ministry of Finance to facilitate the demand. Repatriation exercises are still ongoing and the cost is expected to increase.

Mr. Speaker,

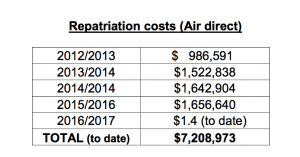

During the period 1st July, 2012 to 26th May, 2017, The Bahamas incurred a total of $7,208,973 in repatriation cost a breakdown of these cost is as follows:

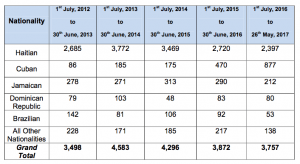

The repatriation statistics for the period 1st July, 2012 through 26th May 2017 are as follows:

Mr. Speaker,

While most of us have had interaction with the Department of Immigration many of us do not comprehend the number of applications which are made to the Department.

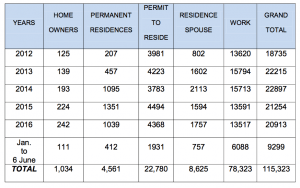

During the period January 2012 to the present 115,323 permits were issued as follows:

As you can see approximately 20,000 per year.

Mr. Speaker,

As I did during my last period as Minister responsible for Immigration, I intend to tackle the backlog of applications and time of processing of such applications.

Immigration Integrated Management System (IIMS)

Mr. Speaker,

The Government signed a Contract with The Canadian Bank Note Company Ltd. (CBN) for the procurement of an Immigration Integrated Management System (IIMS). The scope of the IIMS includes, upgraded border management and application processing technology with the ability to produce new secure Identification documents for The Department of Immigration with integrated biometric identification technology.

The Integrated Immigration Management System (IIMS) is comprised of the following systems:

- Border Management System (Phase I)

- Watch List Management System (Phase I)

- ID Management System (Phase II)

- Detainee Management System (Phase II)

- Document Management System (Phase III)

Mr. Speaker,

The vision for this system is to allow all of the various computerized functions of the Department to seamlessly communicate and work as one overall management resource. In addition, the IIMS will also integrate seamlessly with the new Passport and Visa System that is also being developed by the same vendor.

Border Management System

Mr. Speaker,

Phase I of the project, the Border Management System (BMS) was installed at LPIA in New Providence, GBIA in Freeport, Grand Bahama, Marsh Harbour International Airport in Abaco, and at the Exuma International in Moss Town, in late May 2016. In addition, computers connected to the BMS have also been installed in the Immigration offices on those islands for the purpose of accessing border control functions which can be used at the office. These functions include extension of visitor’s stay and also processing persons having arrived by private vessels (Exuma and Abaco).

The APC (Automatic Passport Control) kiosks were deployed at LPIA during the month of July 2016. Five APC Kiosks have been installed at LPIA and statistics show that almost 50,000 Bahamian Citizens have taken advantage of this self–clearance facility.

Mr. Speaker,

The ability to screen arriving passengers through INTERPOL databases is now an integral function of the BMS and work continues in the effort to make the screening results more accurate through the INTERPOL databases is now an integral function of the BMS and work continues in the effort to make the screening results more accurate through the filtering and manipulation of data.

Mr. Speaker,

The Advanced Passenger Information System (APIS) legislation was passed 26th August 2016, but there are no governing regulations. This short coming will be addressed by my Ministry during this year.

The integration of the APIS into the BMS will require all aircraft and vessel operators entering the country to submit passenger and crew manifests in advance of their arrival in the country in order to facilitate security screening.

Watch List Management System

Mr. Speaker,

The implementation of the Watch List Management System which involved a link with INTERPOL has improved the efficiency of watch list searches. Immigration Officers will continue to remain vigilant in this regard.

ID Management System (IDMS)

Mr. Speaker,

The Department of Immigration is currently developing an ID Management System (IDMS) which will allow for the production of new high security tamper resistant Identification documents to replace the permits cards and certificates currently being issued by the Department.

A sub-component of the Department’s new integrated system is a new ID Management System that will allow the Department to reduce dependency on paper documents and streamline the processing of applications for various immigration matters.

Mr. Speaker,

It is the Department’s intention to roll out this year the service of online immigration application processing. This service will allow submission of applications, progress notifications and online payment.

Detainee Management System (DTMS)

Mr. Speaker,

The Department is finalizing the preparations for the commencement by year’s end, of the Detainee Management System (DTMS) that will serve as a tool to track and manage all persons who are apprehended in the country. These individuals will be accounted for from apprehension to deportation or release.

Document Management System

Mr. Speaker,

The final phase of the Immigration Integrated Management System (IIMS) will involve a Document Management System. This system will allow for the computerization of records inclusive of applications in an effort to reduce the abundance of paper in the Department, thus improving efficiencies.

K-9 Unit

Mr. Speaker,

A K-9 Unit was established in 2016 as a security force to ensure enforcement during boat landings and to serve as escort during the repatriation process. In preparation for the establishment of the Unit, four (4) Immigration officers, two (2) from New Providence and two (2) from Grand Bahama successfully completed a five-month dog handling course in Cuba which commenced in January 2016. Former Corrections Officer and K-9 Specialist Officer, David Rolle now heads that Unit.

Presently, the unit is comprised of five officers and four dogs; two dogs are housed at the Bahamas Corrections Department and the other two are housed at the police kennels in Freeport. Food and medical care for the dogs are taken care of by the Ministry of National Security; two new Ford Taurus vehicles were supplied to the Unit and outfitted for the dogs. The Department is reviewing plans to construct an office building and dog kennels for the K-9 Unit.

Staffing

Mr. Speaker,

The Department has lost experienced staff over the last five years, due to retirement, resignations and transfers. This has left a huge void in the cadre of knowledgeable persons, particularly for the processing of various types of applications.

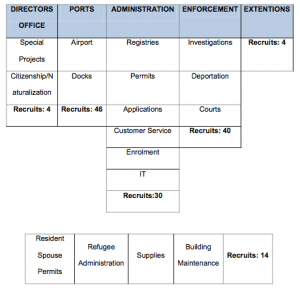

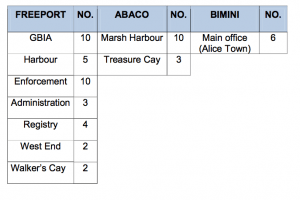

The Department is presently training one hundred and fifty-two (152) Immigration officer recruits in New Providence and fifty-five (55) in Grand Bahama. These officers are scheduled to graduate on 27th July, 2017 and, we hope, will be assigned as follows:

And in the Northern Bahamas

Accommodation

Mr. Speaker,

The Department of Immigration has outgrown its present headquarters building which in addition to being overcrowded is an aging infrastructure.

The facility is being renovated to effect repairs to windows, elevators and bathrooms. This process has caused great inconvenience and shorter working hours. I would like to take this opportunity to thank the staff and the public for their patience during these trying periods. However, the shortage of space is still a huge concern which we will move swiftly to address.

Detention Centre

Mr. Speaker,

The Detention Centre comprises of five (5) dorms, one of which is a medical facility and four(4) to house persons who would have been arrested with the country, and two (2) newly constructed dorms to house those have been refused leave to land at the ports of entry. A portion of the front office building was renovated to house the Enforcement Unit, however, furniture and computers are needed before the space can be occupied.

A major cleanup exercise has commenced that consisted of removing debris accumulated over the years, such as bicycles, discarded construction material, luggage left behind by persons deported in years past, broken bed frames left rusting in the yard area in front of the dorms, abandoned vehicles, broken benches, an old phone booth, and overgrown trees throughout interior and exterior perimeter wall. This exercise is ongoing with hopes to bringing the compound up to cleaner and safer standards. The parking area has been recently re-designed to create more parking spaces.

A Privacy Screen was erected for additional security to deter direct communication between detainees and the general public. Additionally, Signage was recently ordered to be erected at the entrance to the facility. Further, the furniture in the processing area was refurbished and bulletin boards were erected to properly disseminate information to staff and detainees.

The Department will continue to work, in conjunction with the Office of the Attorney General, on the Regulations for the Immigration Reserve and the Regulations for the Detention Centre.

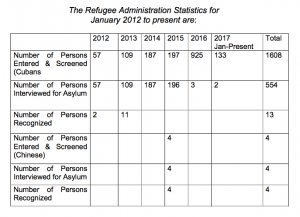

Refugee Administration

Mr. Speaker,

As a result of recent upgrades in the Department’s computer system, new implementation documentation of refugees has been approved to meet international standards. Asylum Certificates and cards will now be available to migrants who qualify.

An extension to this process is the issuance of refugee passports by the Passport Office.

Trafficking in Persons

Mr. Speaker,

The Department of Immigration is a critical agency in this multi-agency initiative. Trafficking in Person is viewed as modern day Slavery, and global estimates range from 20 to 40 million persons as victims in this billion dollar industry. In the vast majority of the cases in The Bahamas so far, the victims have been non- Bahamians.

In accordance with the Trafficking in Persons Act 2012, the Department of Immigration is compelled to issue temporary/permanent status to victims of Trafficking in Persons, and assist police in their investigations (providing arrival records and locations of Victims and Offenders who are non-Bahamians).

In 2016, the Commonwealth of The Bahamas identified nine (9) children as potential victims of Trafficking in Persons and eight (8) adults. All the children had parents who were non Bahamians.

Mr. Speaker,

Armed with the introduction of its new Integrated Management System, the Department of Immigration will continue to work collaboratively with other agencies to ensure and maintain border security.

St. Anne’s is pleased to support the 2017/2018 Budget.